Portfolio Update 12 October 2022

Global markets have remained volatile in recent months, with September having seen major share indices fall sharply, making new lows for the year before recovering slightly.

The three major themes which have impacted markets throughout 2022 continue to dominate market sentiment, namely:

- Global inflation; how high will it get and when will it start to come down, which is impacting –

- Interest rates, with the question being how high will they go, how much longer will it take to get there and how long will they remain there before central banks start to wind back, which is impacting –

- Concerns about a global recession, with the likelihood that these higher interest rates will impact global growth to such an extent that they will cause a global recession.

What we are seeing is any economic news, particularly out of the United States, which impacts investor expectations on these three themes, is causing extreme movements in the US sharemarket (both up and down) which has a knock-on effect to Australia and other global markets. Our view is that this volatility will likely continue for the remainder of the year, whilst interest rates are expected to keep increasing until the first half of next year before hopefully remaining steady for a period of time as their impact on inflation takes effect.

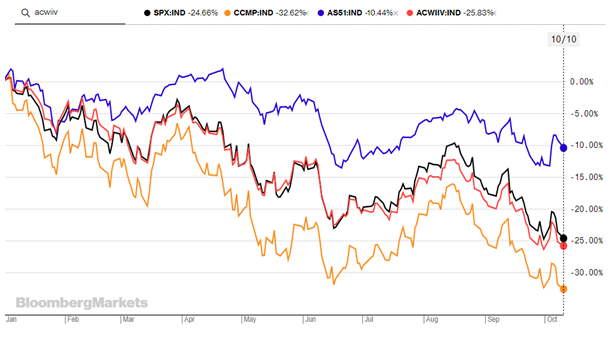

Equities – Year to Date

The chart below shows the performance of the S&P 500 index (broad US sharemarket- black line), the NASDAQ (US technology shares- orange line), ASX 200 (broad Australian sharemarket – blue line) and the MSCI All Countries World Index (broad global large & midcap stocks- red line) over the year to date:

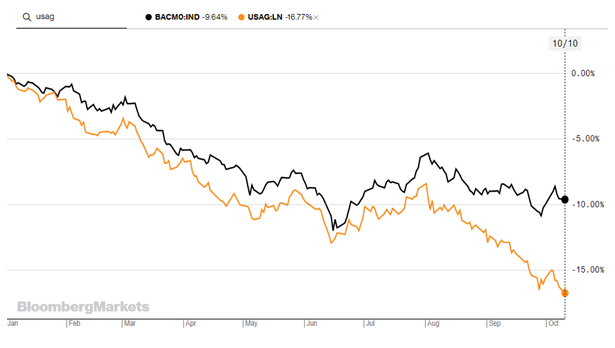

Government Bonds – Year to Date

In addition, long duration fixed interest investments in both Australia (black line) and the US (orange line) have been hit hard over the year to date with rising interest rates having a negative effect on capital values, as follows:

Collins House Strategy

We are sometimes asked why we don’t sell out of investments in times like this, sit in cash and then buy back in when market conditions improve.

We don’t like to try and time the market- that is move from equities to cash and then back again – as history shows it is very difficult to get this right. Two decisions need to be made- the first being when to sell out of equities and sit in cash and then the second when to get back in again. With market volatility, it is really impossible to tell until after the event (and often well after the event) when the top or the bottom of the market is- hence what investors tend to do is wait until they have started experiencing significant falls before they sell and then wait until the market has confirmed it is recovering before they buy back in. Being late in both selling and then buying can be catastrophic, as it can lead to investors locking in the bulk of the losses and then missing out on the bulk of the recovery (with history showing that the early weeks when the market recovers from lows often provide the biggest returns). Our view is that investors who successfully time the market do so based more on luck than good management and don’t do it consistently.

We do, however, employ a “safety net” rule, where if extreme overnight falls occur, we will make significant short-term adjustments to the portfolios’ asset allocation where appropriate and generally move back into the market using a “dollar cost averaging” strategy, usually over 10 weeks.

But in general, we prefer to remain invested throughout, albeit by making tilts in the portfolio towards sectors that are more favoured by the economic conditions and away from those that aren’t. The broad diversification by investing in Exchange Traded Funds also helps reduce the risk. Whilst our model portfolios have suffered falls since the start of the year, the strategy we have implemented has seen portfolios avoid much heavier falls, such as those shown on the index charts above.

We encourage all investors to stick to their long term strategy with their portfolio given, as uncomfortable as it may be, sharemarket history is littered with periods like this and recoveries always follow.

If you wish to review your portfolio in light of the above, please contact your Advisor.