Portfolio update 18 July 2023

Risk assets have performed well in the first half of the year: the S&P 500 and the NASDAQ 100 were both up more than 6.5% in June, posting double digit gains. Apple closed the month at a milestone US$3 trillion market cap, the world’s first company to reach such valuations.

Other factors that fuelled the market’s optimism include a notable revision to first-quarter GDP annualised growth to 2% from 1.3%, better-than-expected economic releases (e.g. US May retail sales, housing starts, jobless claims, consumer sentiment), slowing inflation, as well as comments from the US Fed chairman and Treasury Secretary that downplayed the risk of a recession.

The U.S. is the epicenter of recession concerns but also the diverse market action. The top ten mega-cap names are now trading at valuations ~ 45% above average, while the rest of the market is trading at a modest ~ 13% (Bloomberg).

U.S. inflation was weaker than expected in June adding to the soft-landing narrative. Headline inflation came down to 3.0% y/y and core inflation was 4.8% y/y. This is good news as the disinflationary pulse continues. However, it’s unlikely to be enough to reverse the current course of another rate hike by the Fed later this month. Increasingly the Fed has focused on a ‘super-core’ measure of inflation that shows price changes in services excluding shelter.

Here in Australia, our inflation rate dropped to 7%, from 7.8% in the March quarter reading. Interest rates were held at 4.1% in June and GDP remains positive, but benign, at 0.2%.

Gold Miners (GDX) felt the pressure of a declining gold price, dropping 4.18% during the month of June. Following a dreadful month for gold equities in May, we were pleased to see gold equities performing in line with our expectations in June. In a year when average gold prices have reached record highs (US$1,934 in the first half of 2023), we expect strong gold mining sector fundamentals to progressively reduce the valuation gap between the metal and the stocks.

During FY2023, we remained within the target growth allocation bands for each of the 5 models, predominantly sitting slightly overweight in developed market growth assets (USA, Australia) for the duration of the year. Our International and Australian equity exposure provided a 55% positive contribution to the total return. Most notable was Van Eck International Quality +27.85% and Vanguard Global Value +16.82%.

Our fixed income allocations remained focused on short duration assets (less interest rate risk), highly diversified (less concentration risk) and highly rated fund managers (ability to buy and sell assets through the cycle, rather than take a passive position). This mix resulted in a 34% positive contribution to the overall return. Most notable was Realm high Income +8.57%.

The biggest detractor in the portfolio has been our allocations to infrastructure (Van Eck Global Infrastructure and Clearbridge RARE Infrastructure Income). With central banks having to maintain their hawkish position to bring inflation down to their targets, recessionary risks remain and we would expect that corporate earnings will weaken. In this environment, infrastructure investments, with inflation linked annual rental increases, have historically outperformed as they are rewarded for their ability to generate sustainable earnings and despite the subdued recent returns, we favour retaining them as part of the portfolios.

Changes to our Model portfolios FY2024.

We have made the following adjustments as well as the end of year rebalance of the portfolios. If you use Class Software to view your portfolio, please note there will be a short period to reconcile the allocations.

Developed Markets Equities – we have reduced VVLU, bought VEU, maintained QUAL and

A200.

The Investment Committee has elected to reduce our exposure to US Equities (Value Stocks) and increase our exposure to Japan and European equities. We feel it is a good time to take profits from Value stocks and diversify to other economies, to broaden our exposure and reduce concentration risk to the US market.

Vanguard All World ex US (ASX:VEU) provides exposure to some of the world’s largest companies listed in major developed and emerging countries outside of the USA. It offers low-cost access (0.08%p.a) to a broad diversified range of securities, industries and economies.

Emerging Markets – we have sold EMMG and CNEW, we have bought EMKT.

- We continue to see great value in holding Emerging Market stocks, as demographics, technology and the rising middle class have transformed emerging markets, creating new opportunities to invest in forward-looking, sustainable and structural growth companies. Betashares Emerging Markets (EMMG) has not performed as expected and we are conscious of the associated cost of this managed ETF.

- Chinese Equities are facing economic headwinds and as such we wish to reduce our direct exposure to China, and increase our exposure to India.

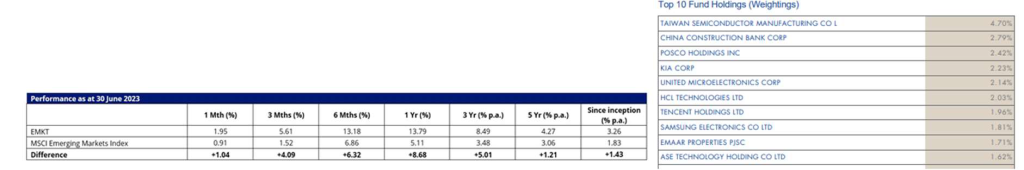

- After careful consideration we have chosen to combine this exposure into the VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT). EMKT provides investors with diversified access to companies that demonstrate four

factors: Value, Momentum, Low Size and Quality, determined by global research giant, MSCI. - EMKT has outperformed the MSCI Emerging Markets Index (benchmark) with a lower associated cost of 0.69%, across every time period as outlined below. Fixed Interest – maintain current positions

Fixed Interest – maintain current positions.

You have probably heard your Advisor mention that as a consequence of rapidly rising interest rates, Government Bond had their worst return in 100 years. With term deposit rates returning to attractive yields (~ 5%p.a ) it is reasonable to ask yourself, why invest into fixed interest securities?

- Return expectations have improved. When interest rates and yields rise, bonds reprice lower immediately. However, cash flows can then be reinvested at higher rates, boosting an investor’s total return over the long term. We believe the worst of the rate rises are behind us and there may be scope to lower rates in 12 to 24 months.

- Yields and spreads have stabilised. Fixed interest markets have shown signs of stabilising in 2023.

- Diversification benefits. Given the current economic and market uncertainty, the diversification benefits of fixed interest are essential. In diversified fixed interest funds, some yields are tracking higher than cash rates and providing much needed income to pension funds.

Our Fixed Interest allocations 1 year returns:

Realm High Income Fund 8.57%

Arculus Preferred Income Fund 5.49%

BetaShares High Interest Cash 3.01%

Returns are net of managed investment fees.

If you wish to discuss any aspect of this update, or review your risk tolerance and investment allocations, please contact your Advisor.