Portfolio Update 22 November 2023

Since our last portfolio update in mid-October, we have seen global share markets hit short term lows at the end of October, with some having fallen by more than 10% from their July highs, before rebounding strongly to date in November.

The drop from August to October was mainly caused by:

- Heightened expectations of further interest rate rises (the “higher for longer” interest rate theme),

- A sharp increase US government bond yields (the 10-year treasury yield topping 5% for the first time since before the GFC), and

- The escalation of the conflict in the middle east adding uncertainty around scale and duration.

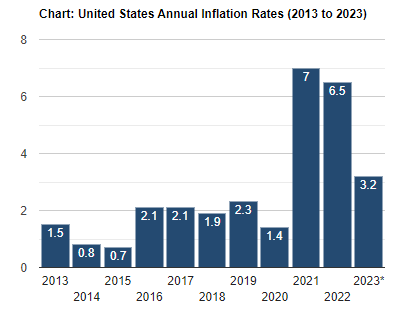

However, since the start of the month we have seen a shift away from the higher interest rate narrative in the US, with better than expected inflation numbers, at 3.2% for the 12 months to October. As the following chart shows, this is a big reduction from December 2022 where the annual rate was 6.5%:

*2023 to end of October.

Source: Trading Economics

Further, following the “good news is bad news” theme that has been prevalent for the past 18 months, there are signs that US employment is cooling which adds to expectation that the US Fed may have finished raising rates.

To put economic growth in context, US GDP is currently 2.9%, Australia 2.1% and the EU 0.1%. Hope remains for a soft landing, whereby the US and Australian economies avoid a recession.

Unfortunately, the inflation story is quite different in Australia.

Whilst our inflation rate is falling, currently at 5.4%, it remains well above the RBAs target band of 2%-3%. Consequently, RBA raised rates by 0.25% in November, with the prospect of another hike to come in early 2024.

However, despite our interest rate outlook being quite different to that of the US, our equities market has ridden the back of the recovery in US shares and has also rebounded strongly this month.

While recent weeks have been encouraging, risks remain and as we have seen in the past 18 months or so, any economic data releases, comments from key US Federal Reserve officials or an expansion of the war in the middle east can quickly change market sentiment.

Defensive and alternative assets (Gold, Silver) have contributed strong returns; therefore, we have been comfortable to maintain a neutral growth allocation for the short term.

Model Portfolio Update

We recently returned to a neutral growth allocation, with small increases to domestic and international equities.

Model Portfolio investors will note that the SMA “Main Cash Account” is sitting much higher than the usual ~1%, as stipulated by Praemium.

Approximately 4.3% of this cash has been earmarked to participate in the following, forthcoming Initial Public Offering (IPO), which is due to settle on the 27th of November.

Issuer: Australian Unity Limited

Security Name: Simple Corporate Bond Series E

ASX Code: AYUHE

Face Value of Bond = $100

Coupon: Floating rate of 2.5% above the 90-day bank bill swap rate (currently 4.4%) = 6.9% per annum

Payment frequency: Quarter commencing 14th January 2024.

Maturity Date: 15th December 2028, but can be redeemed earlier by selling via ASX.

Credit Rating: BBB+.

Commission is payable to Collins House for participation in the IPO and 100% of this will be rebated to the investor.

We believe that this is an exciting opportunity to compliment and build on our existing defensive assets within each of the Model Portfolios.

The risks of default on payments are very low and given the structure of this investment we anticipate minimal volatility.

Australian unity is a mutual organisation that operates a diversified portfolio of businesses including Home Health, Specialist Care, Retail (banking and private health insurance) and Wealth & Capital Markets.

Australian Unity has established an exemplary track record of debt capital markets issuance with its corporate bond issues dating back to 2011.

AYUHE is structed as a simple Corporate Bond, which means that there is no option to convert to equity and interest payments are mandatory.

As this is a bond, and not a hybrid/subordinated bank debt security, there is no franking attached to the coupon.

Should the investment be sold prior to the maturity date, there is a possibility of a gain or a loss to the face value of $100.

If you wish to review your risk profile, or if you do not invest in the model portfolio and wish to discuss your investment allocations, please contact your Advisor.