Portfolio Update 19 December 2023

As the year draws to a close, this email reflects on the drivers of returns for our model portfolios in 2023, and the outlook for 2024.

Inflation and Interest Rates

During 2023 we have seen markets heavily influenced by the macro forces of high inflation and rising interest rates, and the constantly changing outlook for both which has led to continued market volatility.

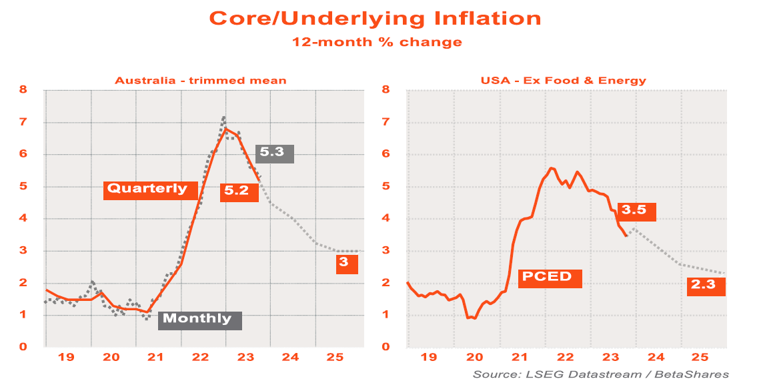

Inflation in the US and Australia has started to trend down, as shown in the following charts:

The orange lines show the actual quarterly 12 month numbers and the dotted lines are the forecasts by the RBA and the Federal Reserve respectively.

The charts show that in the US, inflation is lower than here in Australia and is closer to the central bank’s long-term target.

Consequently, the US Federal Reserve has changed from its “higher for longer” theme of several months ago to a more dovish outlook, where on balance, committee members now anticipate three rate cuts next year.

Here in Australia, the outlook isn’t quite as rosy, with economists divided on whether we will have one more rate rise early in 2024 before hopefully we see rates start to come down later next year.

Hopes remain for a soft landing both here and in the US, meaning inflation is under control and we can avoid a recession.

Both economies have proven to be quite resilient in the face of the constant rate rises of the past 2 years, but we aren’t out of the woods yet.

Fixed Interest Investments

As mentioned in previous updates, the fixed interest exposure in the Collins House Model Portfolios is in short duration or floating rate securities, that is: bonds and other securities whose interest payments are pegged to the Australian Bank Bill Rate.

Whilst Australian interest rates remain high, we should continue to generate strong returns from these investments.

When rates start to fall, the interest paid on these investments will also fall, but the capital values should remain fairly steady.

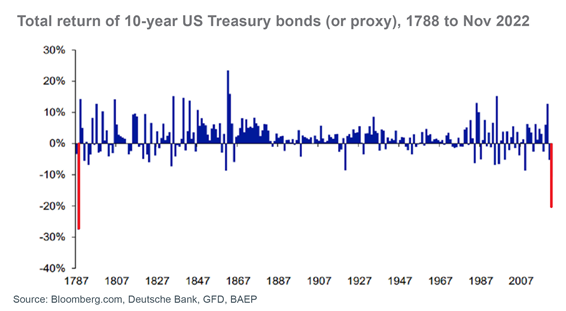

2022 saw the worst annual return for long duration bonds since 1788 (see chart below) due to the rapid interest rate hikes.

There may come a time in the next 12 months where we look to switch to fixed rate or longer duration securities, to lock in the higher interest rates, we will keep you informed of any changes.

Equity Markets

Global share markets over the past 12 to 24 months have been heavily influenced by interest rate expectations.

The recent optimism that the US has completed their hiking cycle and will start to cut next year, has sent the three major US share indices (S&P500, Dow Jones and Nasdaq) on a 7-week winning streak, with the Nasdaq and Dow Jones recently hitting all time highs (and the S&P500 close to a high).

The Australian share market and parts of Europe have also pushed higher over this period, though not to the same extent.

Equities in the US have been driven largely by the big technology companies over the past 12 months and as a result, the overall market looks expensive when compared to historical valuations.

However, when you strip out these large tech players, there is still value in the US market with an encouraging earnings outlook.

In Australia, our overall market looks fairly valued, however the earnings outlook is not as strong as the US. ASX200 earnings have only grown at around 4% p.a. over the last 20 years and 3% p.a. over the last 10 years.

Consensus expectations are for this to be even lower over the next few years, given the low growth forecast for the large banks and resources sectors.

European shares in general haven’t risen as strongly as the broad US market, being more value than growth orientated, so we believe there is further scope for gains in that region.

Model Portfolio Update

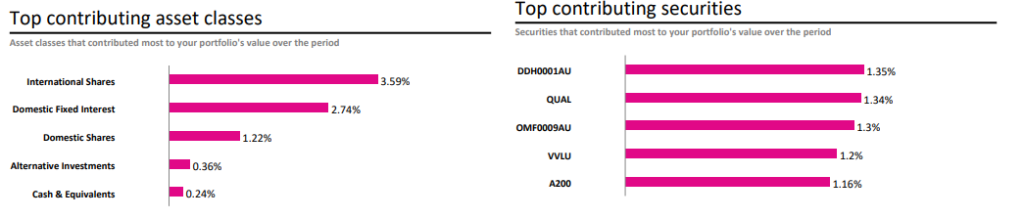

Pleasingly, it has been a positive year for our model portfolios, with all funds generating returns ahead of their benchmarks.

We continue to equally spread our equity allocations over high quality growth and international value stocks, with a slight tilt to the USA, and have allocations to both large and small cap companies, Europe, Asia, Australia and Emerging Markets.

We have also maintained our exposure to gold and silver, gold miners and global healthcare companies, as well as “floating rate” fixed income as described earlier.

Based on our Model Portfolio #3 “Balanced” returns, the top contributing assets and securities for 2023 were:

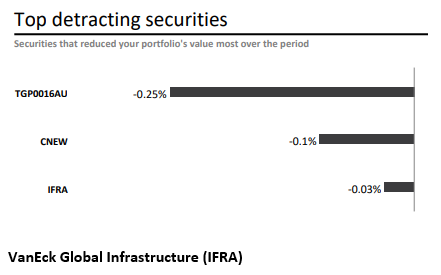

The top underperformers for 2023 were as follows, noting that CNEW was sold in July and Clearbridge Infrastructure (TGP0016AU) was sold in October.

VanEck Global Infrastructure (IFRA)

We have maintained our holding in VanEck Global Infrastructure (IFRA), despite the negative 2-year return, as we maintain our position that infrastructure assists to diversify our asset allocation and provides good returns for the levels of associated risk, over the longer term.

The characteristics of infrastructure assets (stable, long-life; cash generative; low sensitivity to the economic cycle) makes them relatively sensitive to changes in interest rates, compared to global equities. Given the outlook for US interest rates in 2024 is negative, we anticipate a return to more positive returns.

A reminder of what IFRA invests in:

- 50% Utilities;

- 30% Transportation; and

- 20% Others e.g Pipelines.

Companies within Transportation are further capped as follows:

- 22.5% Heavy construction, transportation services and business support services; and

- 7.5% Railroads, travel & tourism.

Investment profile:

- Individual stocks are capped at 5%.

- 54.5% is invested in the USA, 7.7% Australia and the remainder spread across 16 countries.

- The fund is hedged to AUD, which had a negative impact in 2022 and for most of 2023 as the USD appreciated against most currencies, due to rising rates and a flight to safer currencies. This is until the recent fall, which has provided a boost to overall returns.

- 1 year income return = 3.1%.

- falling interest rates and bond yields provide a favourable environment for infrastructure assets.

On behalf of everyone at Collins House, we wish you and your families a safe and enjoyable festive season.

A reminder that our office is closed from 5pm Thursday 21 December and re-opens on Monday 8 January.

If you have an urgent need to contact us during that time, please email dalafaci@collinshouse.com.

We look forward to seeing you all again in 2024.