Portfolio Update 21 August 2023

Market performance for the month of August brings to mind the Jaws 2 tag line, “Just when you thought it was safe to go back into the water”. The 1-month index returns across the board are red!

1 month returns are as follows: S&P/ASX200 (Australia) is down 2.36%, the S&P500 (US) is down 3.67% and the EuroStoxx50 is down 4.06%.

We need to be mindful that August and September are historically volatile months. Northern hemisphere investors are largely enjoying a summer break, therefore trade volumes are typically lower which makes the market more concentrated. However, add into the mix a plethora of economic data (Corporate earnings, unemployment, inflation etc) and investors are hyper-sensitive to news. For example, positive US economic data showing a tight labour market, strong retail sales and an expanding economy would normally result in positive prospects for equities. However, in this current climate a strong economy may give scope to the Central Bank to further increase interest rates which in turn puts pressure on equities, and other asset classes.

With regard to these matters, we would encourage investors to turn down the noise and concentrate on longer term investment goals, noting that this is part of the market cycle. Particularly those with time and an ability to dollar cost invest will benefit from short term volatility.

China

The narrative around China’s post-COVID-19 reopening was one of the more dominant themes at the beginning of 2023. However, their greater focus on consumption of services and lesser focus on infrastructure investment has been less supportive for commodity demand, and subsequently Australian miners have suffered.

The graph below charts the Australian Dollar (AUS / USD) and the Iron Ore Price; the strong correlation shows how sensitive our currency is to Chinese demand. Whilst there are myriad of factors which influence currency movement, risk, interest rates and commodities dominate the AUD.

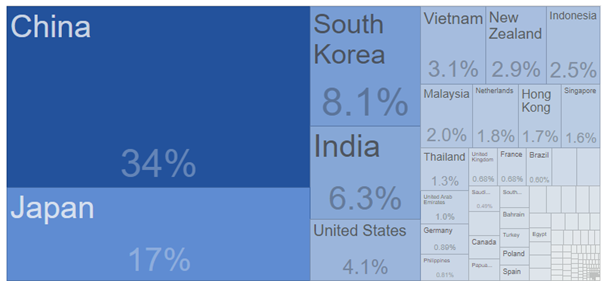

This graph displays a table with Australia Exports By Country in U.S. dollars, according to the United Nations COMTRADE database on international trade.

Most recently, financial news is being dominated by a Chinese Property market and associated $3 Trillion shadow banking system:

- Real estate accounts directly and indirectly for 30% of Chinese GDP.

- Developers (such as Country Garden, Wanda, Shui On Land, etc.) are missing bond payments and increasingly seeking debt restructuring.

- Macro data, especially that related to property, continues to deteriorate.

The Peoples Bank of China (PBOC) recently cut its short-term loan rates, as well as its medium-term lending facility rates however, this did little to settle markets. They meet again on the 21st August to review and economists at Goldman Sachs and Barclays are among the many who expect the PBOC to lower its one-year loan prime rate by 15 basis points to 3.40%, which would be a new low. There are calls for monetary and fiscal stimulus, which should positively impact equity markets and bolster commodities like Iron Ore, Copper and Coal. Whether this is part of China’s strategic economic plan, we will have to wait and see.

CH Model Portfolio

The Investment Committee has elected to hold positions for August. We remain approximately 5% overweight to the neutral position, retaining this exposure in Alternatives such as Gold, Silver and Gold Miners. We are confident that the changes made to the portfolios in July, position us well to ride through the current volatility. We will continue to monitor changes in the Global markets and if necessary, make adjustments.

If you have questions, or you wish to review your tolerance to investment risk, please speak with your Financial Advisor.