About This Newsletter

Welcome to the Collins House Private Wealth client information newsletter, your monthly tax and super update keeping you on top of the issues, news and changes you need to know. Should you require further information on any of the topics covered, please contact us via the details below.

T: 03 9629 6922

E: mail@collinshouse.com

Level 13, 90 Collins Street, Melbourne VIC 3000

PO Box 24175, Melbourne VIC 3000

Collins House Newsletter: November 2023

Who can I nominate as my super beneficiary?

Your superannuation death benefits must be paid to someone when you die. That somebody will usually be your estate or your nominated beneficiary (also known as your dependants).

Paying death benefits to your estate Unlike other assets such as shares and property, your superannuation and any insurance benefits you have in superannuation do not form part of your estate.

That’s because your superannuation is not held by you personally, rather it is held in trust for you by the trustee of your superannuation fund.

However, you can direct your superannuation death benefit to your estate by nominating your ‘legal personal representative’ (LPR), who will usually be the executor of your estate.

If you nominate your estate or LPR, you must also specify in your Will who you want to distribute your superannuation money to. This can include eligible beneficiaries (see below) as well as anyone else you wish to leave your death benefits to. As such, it’s important that the directions stated in your Will are up to date so your LPR pays out your death benefits (as well as your other estate assets) as per your wishes.

Paying death benefits to a beneficiary/dependant: If you want your superannuation death benefits to be paid to a person, that person must be a ‘dependant’ for super purposes.

The meaning of dependant is important as it determines who can receive a death benefit, whether the death benefit will be taxed and in what form your death benefit can be paid out (ie, lump sum, income stream, etc). In particular, superannuation law determines who can receive your super directly from your super fund without having to go through your estate. These people are your superannuation dependants. Tax law on the other hand determines who pays tax on your

superannuation death benefit. These people are considered tax dependants.

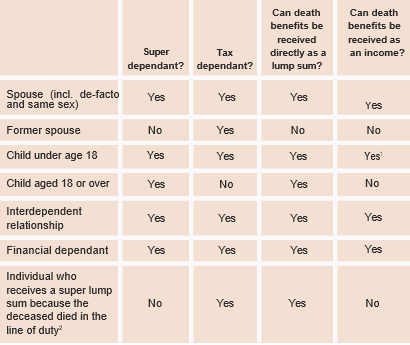

The table below summarises the difference between:

■ a superannuation dependant and tax law dependant, and

■ the types of death benefit that can be paid to each category of dependants.

As can be seen, the key differences between the superannuation and tax dependant definitions are:

■ a tax dependant does not include an adult child (whereas a super dependant does), and

■ a tax dependant includes a former spouse (whereas a super dependant does not).

Although your financially- independent adult children are your superannuation dependants and can receive a death benefit directly from your superannuation fund, they are not tax dependants. This means they will not receive more favourable tax treatment than a tax dependant would receive unless they qualify under an ‘interdependency relationship’ or are financially dependent on you. A tax dependant will generally not pay any tax on superannuation death benefits. In contrast, a non-tax dependant is taxed on any taxable components of a superannuation death benefit. This could be up to 15% tax plus Medicare levy on any taxable component and potentially up to 30% plus Medicare levy for any taxable untaxed elements within your fund.

Need help?

Please contact us if you would like further information about who you can nominate to receive your superannuation death benefits.

1 Income stream must be commuted by the time the child turns 25, unless the child has a

prescribed disability.

2 Deceased died in the line of duty as a member of the Defence Force, Australian Federal

Police, the police force of a state or territory, or as a protective service officer.

Who is a resident for tax purposes?

A person’s residency for tax purposes can be one of the most difficult issues to determine in Australian tax law. And it is not just a question of whether a person is a ‘citizen’ of Australia.

Moreover, it is highly relevant from a tax point of view, as a person who is a resident of Australia for tax purposes is liable for tax in Australia on their income from ‘all sources’ (ie, both from Australia and overseas) – including capital gains. On the other hand, a person who is not a resident of Australia for tax purposes is only liable for tax in Australia on income and capital gains that are considered ‘sourced’ in Australia.

A recent decision of the Administrative Appeals Tribunal (AAT) illustrates some of the issues involved in determining this complex matter (see PQBZ v FCT [2023] AATA 2984). In that case, the AAT found that the taxpayer was a resident of Australia for tax purposes under the ‘ordinarily resides’ test or principle – without having to consider the ‘subsidiary’ tests which involve, for example, questions of the person’s ‘domicile’ and whether they intended to take up residency in Australia. Significant to the AAT’s decision was that, apart from his business interests in an overseas country and the unit he lived in there to carry on that business, all of the taxpayer’s personal (and other) ‘connections’ were otherwise clearly with Australia.

These Australian connections included his family home, his personal and other business assets, where his wife and children lived, Australian bank accounts and his Australian health insurance. It was also relevant that for the several years in

question, the majority of the time he had spent living in Australia. As a result the taxpayer, as a resident of Australia for tax purposes, was liable to tax in Australia on his overseas business income. But not all residency issues are apparently as clear- cut as this. In other cases, it is necessary to consider issues such as whether the taxpayer has been in Australia for half the income year or more and whether they intend to take up residency in Australia.

It may also be necessary to consider the complexities of any ‘double tax agreement’ with the country in question. And suffice to say, if the issue is relevant to you, not only is the advice of your professional adviser invaluable, it is also essential.

If you’ve been putting off upgrading the inefficient office air-conditioner, a new 20% bonus deduction might just be the incentive you need to help beat the heat before it arrives with a vengeance!

Whilst the small business Technology Investment Boost has now ceased1, not only can you still take advantage of the Skills and Training Boost (generally for expenditure on training employees incurred before 30 June 2024), but there is also now a new kid in town – the small business Energy Incentive!

Similar in design to the earlier ‘boosts’, the proposed Energy Incentive provides a bonus tax deduction of 20% of expenditure on improving the energy efficiency of your business. Up to $100,000 of expenditure can be eligible for the incentive, with the maximum bonus tax deduction being $20,000 for the 2023-2024 tax year.

What type of expenses are eligible for the bonus? Where you can show improved energy efficiency, expenditure on electrifying heating and cooling systems, upgrading appliances such as fridges and cooktops, and installing batteries, heat pumps and off-peak electricity monitors can all be eligible. (As always, there are some exclusions, such as expenditure on motor vehicles, building improvements and financing expenses.)

Although this proposed Energy Incentive is not yet law, it is an opportune time to consider whether your business may want to take advantage of the bonus and undertake the preparation and ‘leg work’ needed to ensure you can maximise the bonus.

Qualifying as an interdependent or financial dependant

A question that often gets asked when dealing with death benefit nominations is whether a person will qualify under the interdependency or financial dependency definitions. This is an important consideration as meeting the dependency criteria will enable potential beneficiaries to qualify as a dependant and therefore allow them to receive a death benefit.

INTERDEPENDENCY RELATIONSHIP

Put simply, an interdependency relationship exists between two people if all of the following conditions are met:

1. They have a close personal relationship

2. They live together

3. One or both provides the other with financial support

4. One or both provides the other with domestic support and personal care.

However, if two people satisfy the close personal relationship requirement but cannot satisfy the other three requirements, they can still satisfy the interdependency relationship if:

■ Either or both of them suffer from a physical, intellectual or psychiatric disability, or

■ They are temporarily living apart (eg, overseas or in jail).

There is no easy way in determining whether an interdependent relationship exists, however superannuation law provides the following list of considerations to help superannuation fund trustees determine if an interdependency relationship exists (or existed before one of the parties died):

■ Duration of relationship

■ Whether or not a sexual relationship exists

■ Ownership, use and acquisition of property

■ Degree of mutual commitment to a shared life

■ Care and support of children

■ Reputation and public aspects of the relationship

■ Degree of emotional support

■ Extent to which the relationship is one of mere convenience

■ Any evidence suggesting that the parties intend the relationship to be permanent

■ A statutory declaration signed by one of the persons to the effect that the person is or was in an interdependency relationship with the other person.

It is not necessary that each of these factors exists in order for an interdependency relationship to exist. Instead, each factor is to be given the appropriate weighting depending on the circumstances.

FINANCIAL DEPENDANT

If a beneficiary fails to meet the interdependency relationship criteria, they may qualify as a financial dependant. Being financially dependent on the deceased generally means you relied on them for necessary financial support. This also applies to children over 18 years old as they must be financially dependent on the deceased to be considered a financial dependant.

That said, the term financial dependant is not expressly defined in superannuation or tax legislation, so it takes on the ordinary meaning of that term. As such, the definition of financial dependant is reliant on case law and comes down to the facts of each case. In most cases, it is not the value of payments received from the member that establishes financial dependency but the degree of dependency on that payment. This includes the extent the person relies on the financial support provided by another person to meet basic living expenses.

For example, a grandparent who chooses to pay school fees for their grandchild is unlikely to have their grandchild qualify as a financial dependant. This is mainly due to the fact that the payment is seen to be more discretionary in nature than providing for an essential element of life, such as food or shelter.

In summary, superannuation case law provides more flexibility for someone to be partially or wholly dependent, whereas tax dependency takes a stricter approach as a substantial degree of dependency is required.

How to nominate a superannuation beneficiary

There are many types of nominations offered by different funds. Knowing which one suits your circumstances is key to ensure your superannuation ends up in the right hands.

Types of nominations

Individuals can direct or influence their superannuation fund trustee as to how they want their death benefits distributed by completing a death benefit nomination form.

Superannuation funds offer a range of death benefit nominations, including:

■ Non-binding death benefit nominations

■ Binding death benefit nominations

■ Non-lapsing binding nominations

■ Reversionary pension nominations, and

■ In the case of an SMSF, executing a trust deed amendment or using one of the above types of nominations.

However not all funds will provide all options to their members, and completion of these forms is best done by the member in conjunction with their adviser and an estate planning lawyer in the first instance.

Non-binding death benefit nomination

This is the most common type of death benefit nomination and is offered by most superannuation funds. A non-binding nomination is an expression of wishes which is not binding on trustees. The trustee of your superannuation fund will look at the nomination you make, but will exercise discretion to determine which of your beneficiaries receives your superannuation and in what proportions.

Binding death benefit nomination

A binding death benefit nomination is a written direction from a member to their superannuation trustee setting out how they wish some or all of their superannuation death benefits to be distributed. The nomination is generally valid for a maximum of three years and lapses if it is not renewed. If this nomination is valid at the time of your death, the trustee is bound by law to follow it.

Non-lapsing binding death benefit nomination

This is a written direction by a member to their superannuation trustee establishing how they wish some or all of their superannuation death benefits to be distributed. These nominations generally remain in place forever unless you cancel or replace it with a new nomination. If this nomination is valid at the time of your death, the trustee is bound by law to follow it.

Reversionary pension nomination

If you are in receipt of an income stream, you can nominate a beneficiary (usually your spouse) to whom the payments automatically revert upon your death. With this type of death benefit nomination, the fund trustee is required to continue paying the superannuation pension to your beneficiary if your benefit nomination is valid.

SMSFs and death benefit nominations

If you are an SMSF member and want to make a death benefit nomination, it is important to review your fund’s trust deed requirements to determine the rules regarding death benefit nominations. Although the High Court recently ruled in the case of Hill v Zuda Pty Ltd [2022] that traditional three-year lapsing binding death benefit nominations do not apply to SMSFs, many trust deeds expressly include the traditional requirements. If this is the case, they must be complied with, and the nomination will lapse.

What if there is no nomination or an invalid nomination?

If you have not made a nomination, your superannuation fund will have rules for determining the death benefit recipient(s). In many cases, funds will either exercise discretion and follow the same process as if a member had a non-binding

nomination, or pay your benefit to your legal personal representative (LPR). The risk with this option is if you don’t have a Will, your benefit may be distributed under the relevant state laws for dealing with intestacy!

Similarly, if your nominated beneficiary does not meet the definition of a superannuation law dependant at the time of your death, the nomination will be deemed invalid. Again, it will come down to your fund’s rules which may determine that your benefit must be paid to your LPR or alternatively that the trustee exercise their discretion.

Check your nomination

Remember to regularly review your superannuation death benefit nominations when your circumstances change to ensure it remains up to date and ends up in the hands of the right person(s).