Portfolio update 16 November 2022

Please find attached the Collins House Model Portfolio Update for November 2022.

Investment markets

Global shares rallied last week, aided by lower than anticipated US inflation figures, which markets perceive will take the pressure off the US Fed Reserve and ultimately other central banks including the RBA.

Globally, Central Banks have been in part trying to curb inflationary pressures at home and keep in step with the Fed. This news helped to drive up the Australian share market by around 3.4% for the week with gains-led utilities, materials, health and property stocks. The lower US inflation data also pushed bond yields down sharply, in line with a lowered future rate expectation. Oil prices fell, aiding inflation figures. The US dollar fell, which boosted Gold Miners and iron ore prices also benefitted from the risk on sentiment.

US inflation finally appears to be easing, with headline inflation in October dropping down to 7.7% year on year (peak of 9.1% in June). More importantly, core inflation eased to 6.3% year on year from 6.6%. Prices for used cars, household furnishings, medical care and airfares fell.

China is seeing another upswing in new Covid-19 cases threatening more disruption under its zero-Covid policy. However, there are many signs pointing to an easing ahead in the zero-Covid policy probably early next year. This could mean that after surprising on the downside this year, Chinese growth will likely surprise on the upside next year, which in turn could provide an upside boost to global growth.

It has undoubtedly been a horrendous year for markets across the board, but it has particularly been hardest on Growth stocks and long dated Fixed interest securities.

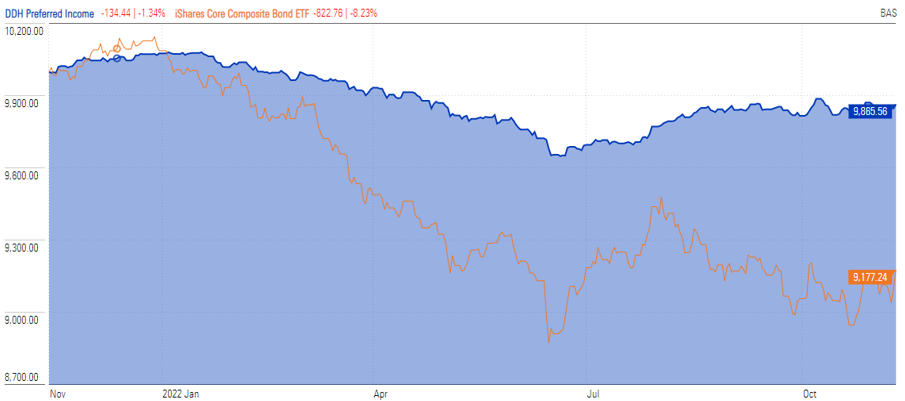

Switching from VGAD to VVLU 12 months ago has provided our portfolios with significantly better performance (Graph 1), as has short duration DDH Preferred Income, higher yield credit over Government debt securities IAF – UBS Composite Bond Index (Graph 2).

Collins House Model Portfolio returns 31st October 2022

We have started to see a positive return to some sectors of the portfolio, in particular equities, as reflected in the model returns outlined below.

Looking beyond 31st October, you can see in Model #3 (our Balanced portfolio) below, that markets are trending upwards in October and November and despite a difficult 12 months; the overall trajectory from inception has been up. The old mantra of time in the market, continues to ring true and reward those who remain patient.

Outlook for investment markets

Equity markets may continue to face short term volatility while Central Banks continue to tighten, uncertainty about recession remains high and geopolitical risks continue.

However, we are now in a favourable part of the year for shares from a seasonal standpoint, and we see shares providing reasonable returns on a 12-month horizon as valuations have improved, global growth is expected to improve and inflationary pressures should ease through next year, allowing central banks to ease up on interest rate hikes. With bond yields likely at or close to peaking for now, short-term bond returns should improve. With this in mind, our Investment Committee has met to review the allocations and we have decided to increase our allocation to growth investments over the coming months. Specifically, to the following investments (Model #3 will hold 3% in each new investment).

VanEck MSCI International Small Companies Quality ETF (QSML) gives investors a diversified portfolio of 150 international developed market small-cap quality growth securities. The portfolio contains some of the world’s highest quality small companies based on three key fundamentals: (i) high return on equity; (ii) earnings stability; and (iii) low financial leverage.

Vanguard MSCI Australian Small Companies Index ETF (VSO) provides low-cost, broad diversified exposure to 211 small companies listed on the Australian Securities Exchange. The sectors in which the ETF invests include industrials, materials and financials. Forecast yield 3.2%.

We will also rebalance the existing allocations, so please expect to see changes in the portfolio in Praemium and/or Class client viewing.

If you wish to review your portfolio or risk profile, please contact your Advisor.