Portfolio update 22 May 2023

Market Update

Since our last update in mid-April, sharemarket returns have been mixed, with the ASX 200 down slightly and the US S&P500 up slightly, whilst European markets have been mixed.

The economic backdrop of still high inflation, rising interest rates and recession concerns remains. We saw the Reserve Bank of Australia lift interest rates by a quarter of a percentage point at its May meeting, which was a surprise to many after pausing in April and indications are that there are further rises to come which will place even more pressure on mortgage holders. Australian rates are now at their highest level since April 2012.

Meanwhile in the US it is a similar story with the Federal reserve having increased rates by a quarter of a percentage point in May, bringing rates to their highest level in 16 years, and its 10th rate hike since March 2022. There was, however, an indication in the wording of the Fed’s statement following the May hike that indicated that rate rises may be nearing an end.

US economists are forecasting that a jump in unemployment and major job losses over the next 12 months are likely to push the US economy into a recession and the same risks are present here in Australia and in Europe.

US Debt Ceiling

The major concern for markets in the immediate term is the raising of the US debt ceiling, which is the statutory limit on the government’s power to borrow to pay its debts. If the debt limit isn’t raised by 1 June, then the US would default on its debt, an event that would be catastrophic for the economy and markets. Negotiations between Joe Biden and Republican speaker Kevin McCarthy will be scrutinized this week, with McCarthy and the Republicans demanding that Biden cut spending in exchange for raising the debt limit.

Analysis by the White House Council of Economic Advisers illustrates that if the US government were to default on its obligations, the economy would quickly shift into reverse with the depth of losses a function of how long the breach lasts. It is obviously hoped that common sense will prevail and an agreement will be reached to avoid such an outcome.

Portfolio Update

All of our model portfolios had a positive month in April and have been up strongly over six months.

As we detailed in our April update, we have positioned the portfolio for the expected economic slowdown, maintaining exposure to precious metals and infrastructure and also short duration bonds which are offering very attractive yields to maturity. We have not made any changes to the portfolio since our last update, however we are constantly monitoring the situation and considering options which may enhance portfolio performance. Any future changes will be communicated to you.

End of Financial Year Fast Approaching

Changes in Minimum Account Based Pensions from 1 July 2023

The temporary Covid minimum drawdowns for Account Based Pensions will cease from 1 July 2023, with minimums reverting back to “normal”. To recap, pension minimums are age based as follows:

If you are in a public offer fund (such as Praemium or North), our understanding is that, if your current pension is under the increased minimums at 1 July, they will be automatically increased. If you are in a Self-Managed Super Fund, the new minimums will appear in Class.

Pre 30 June 2023 Strategies

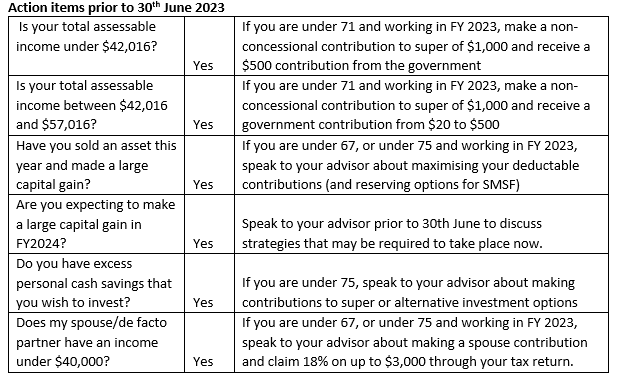

We are fast approaching the end of another financial year, and we would like to take this opportunity to ensure that you are made aware of end of financial year super and tax strategies.

Please take the time to read through the below and if applicable, please contact your Advisor to discuss well before 30th June, so we can assist you.

Do not forget that the current concessional (tax deductible) contribution limit is $27,500 (less your employer or salary sacrifice contributions) and you may have a gap that you wish to fill prior to 30th June, to reduce your taxable income for this financial year.

Important considerations

- Check that your Superannuation death benefit nomination is up to date.

- Review your existing insurances.

- Ensure that you have an up-to-date Will and Powers of Attorney in place.

- Review your attitude toward investment risk

- Tell your advisor if you have had a significant change to your personal or financial circumstances.

If you have any questions about the above, or would like to discuss your portfolio in more detail, please don’t hesitate to contact your advisor.