Portfolio update 26 June 2023

Market Update

Since our last update on 22 May, sharemarket returns have been mixed, with the Australian market (ASX200) down around 1%, whilst US markets are higher on the back of technology stocks and European markets have been mixed.

Despite the continuing economic concerns of sticky inflation, continuing rises in interest rates, a potential global recession and also the Russia and Ukraine war, sharemarkets (and in particular the US) have seen strong returns over the past 9 months, recovering strongly from the September 2022 lows.

When we take a deep dive into what has caused this sharemarket rebound, in the US in particular, it has been driven by technology stocks and in particular Artificial Intelligence. Returns from mega-cap tech stocks such as Alphabet, Meta, Apple, Amazon and Nvidia have been the largest in the past two decades and are the reason why returns from the Nasdaq and S&P 500 have significantly outpaced those of the Dow Jones. Given the Australian market doesn’t include any of these big name tech companies, our market has also been subdued.

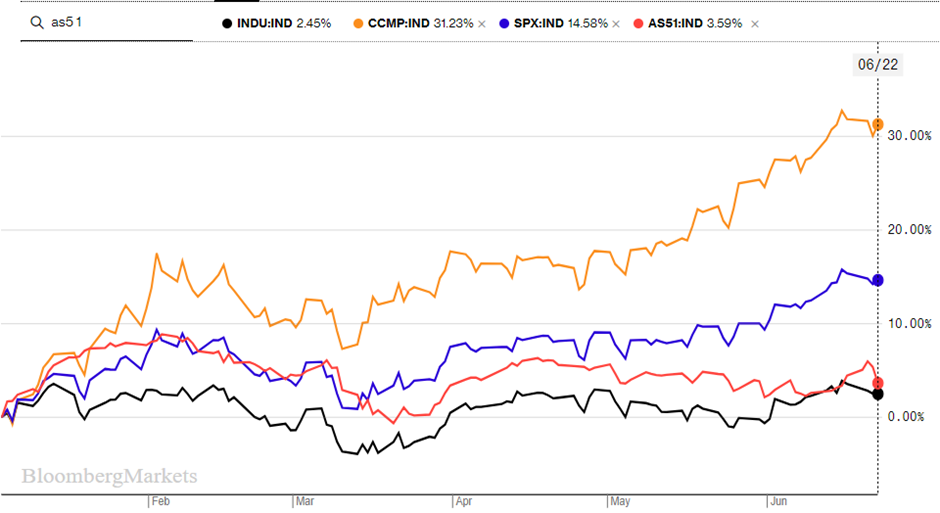

Below shows the performance of the ASX200 (red), the Down Jones (black), the S&P500 (blue) and the Nasdaq (orange) since the start of 2023:

With recent comments from US Federal Reserve Chairman Jerome Powell that he sees a couple more rate rises before the end of this calendar year, concerns have heightened that this will push the US into a recession. The same concerns are present here in Australia and in parts of Europe. So, we remain cautious.

Portfolio Update

We have not made any changes to the portfolios since our last update, with the portfolio continuing to be positioned for the expected economic slowdown. There are some tactical allocation changes that we are discussing at the moment and if any changes are made we will let you know.

We continue to have concerns about the commercial property market, particularly here in Australia. It was reported this week that Dexus, one of the country’s largest office tower owners wiped $1 billion from the value of its office portfolio, while other landlords have also reduced their property valuations. There is a concern that there are more revaluations to come, as valuers and landlords tend to smooth valuations over an extended period (and not do it all in one, big hit).

The portfolios have a minimal exposure to this space following the sale of the Vanguard Australian Property Securities Index ETF back in April this year.

Below we touch on some of the investments that are in the portfolio:

QUAL (VanEck MSCI International Quality ETF) and QSML (Vaneck MSCI International Small Companies Quality ETF)

With the previous comments about tech stocks driving the market, your portfolio has exposure to these companies through QUAL and QSML, both of which have had strong returns over the year to date.

Below shows the top 10 holdings in QUAL at the time of writing, reflecting those big names previously mentioned:

These Exchange Traded Funds identify companies with high quality scores based on three key fundamental factors: high return on equity, stable year-on-year earnings growth and low financial leverage. We would expect that these types of companies should hold up fairly well in a slowing economy.

Infrastructure

The returns from infrastructure investments (Clearbridge and IFRA) have been disappointing over the past 6 months, particularly in comparison to the returns from technology companies as discussed.

Infrastructure assets performed strongly early last year when everything else was falling, but have come off since as capital has flowed back into stocks and particularly technology stocks as mentioned.

With central banks having to maintain their hawkish position to bring inflation down to their targets, recessionary risks are increasing and we would expect that corporate earnings will weaken (we are starting to see that already in some sectors). In this environment, infrastructure investments, with inflation linked annual rental increases, have historically outperformed as they are rewarded for their ability to generate sustainable earnings and despite the subdued recent returns, we favour retaining them as part of the portfolios.

Below shows the top 10 holdings of IFRA, all of which are quality investments:

Fixed Interest Investments

Although the general classification of investments in Realm and Arculus is under “Fixed Interest”, these investments are more floating interest, investing in debt instruments which provide a floating rate of return, which is typically pegged to the Bank Bill rate. This means as interest rates have been rising, the yields on these investments have also been rising. These investments were able to get through 2022 relatively unscathed, whilst fixed interest securities on average had their worst 12 months since the early 1900s!

We are now starting to see some improved returns from this defensive part of our portfolios.

At the end of May, the yield to maturity on the Realm High Income fund was 7.93%, and on the Arculus Preferred Income fund it was 7.15%. This means that if all bonds in the portfolios are held to maturity, then the combination of capital growth and distribution for both realm and Arculus will be over 7%.

Reminder of return to “Normal” Account Based Pension minimums from 1 July 2023

The temporary Covid minimum drawdowns for Account Based Pensions will cease from 1 July 2023, with minimums reverting back to “normal”. To recap, pension minimums are age based as follows:

| Age | Pension Drawdown Level from 1 July 2023 | 2022 FY and 2023 FY COVID relief Pension Drawdown Level |

| Under 65 | 4% | 2% |

| 65 -74 | 5% | 2.5% |

| 75 – 79 | 6% | 3% |

| 80 – 84 | 7% | 3.5% |

| 85 – 89 | 9% | 4.5% |

| 90 – 94 | 11% | 5.5% |

| 95+ | 14% | 7% |

If you are in a public offer fund (such as Praemium or North), our understanding is that, if your current pension is under the increased minimums at 1 July, they will be automatically increased. If you are in a Self-Managed Super Fund, the new minimums will appear in Class.

If you have any questions about the above, or would like to discuss your portfolio in more detail, please don’t hesitate to contact your advisor.