Portfolio Update 9 October 2023

At the time of writing the S&PASX 200 is up 0.5%, to 6985.6 (10.30am AEDT), spurred by Energy (Oil has surged 4%) and Gold stocks, after the horrific attacks on Israel over the weekend.

We are yet to see the impact on US and European markets, both of which were up on Friday due to better than expected US jobs figures.

What we do expect, is higher volatility and a rise in allocations to safety assets such as Bonds, Gold and the US Dollar.

We have recently made some changes to the model portfolios, as detailed below, and we are poised to make further adjustments should the markets react negatively to the conflict in Israel.

For those of you who may have friends or family impacted by this conflict, we offer our condolences and hope for a swift resolution for stability and peace.

October markets

It is often said that October is historically the best performing month for stock market rallies. What that statement fails to address, is that a big reason why October has so many follow-through days (a sign that institutions are supporting a new stock market rally attempt) is because the stock market often bottoms in October. The major indexes often suffer big losses in October, sometimes compounding sharp declines from prior months.

Investors can’t assume that the big gains will kick in immediately when October starts, nor can we assume that this October will be the same as the last.

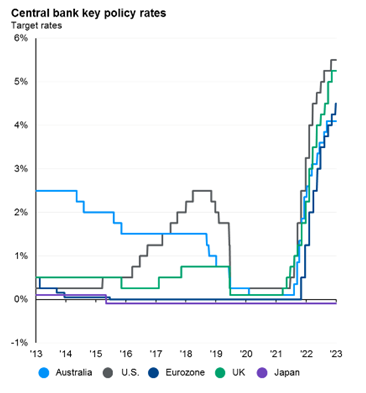

We are all acutely aware of the rise of global political tensions, inflationary pressures on households and global Central Bank’s aim to reduce inflation, by raising interest rates at the fastest pace since the late 1980’s.

Whilst many issues from 12 months ago remain (inflation, interest rate pressures and geopolitical tensions), the Australian share market (ASX200) has remained relatively flat, the US market (S&P500) as well as other markets such as Europe (STOXX 600) have performed well over the past year and coupled with improved returns from cash and fixed interest, have helped our model portfolios perform strongly in the year to September.

| Portfolio | 12 Month Return to 30 /9/2023 (after fees) |

| Model Portfolio #1 – Defensive | 6.61% |

| Model Portfolio #2 – Moderately Defensive | 8.02% |

| Model Portfolio #3 – Balanced | 9.09% |

| Model Portfolio #4 – Growth | 10.84% |

| Model Portfolio #5 – High Growth | 12.72% |

Whilst the future always presents uncertainty, it can also present opportunities. Conventional wisdom tells us that higher interest rates are generally not great for share market investing however, investing in a well-managed diversified portfolio continues to be appropriate for long-term investors as alternative assets and Bonds will generally perform when rates stabilise.

Model portfolio update

The Investment Committee has met and reviewed the current allocations, keeping in mind the “higher for longer” interest rate world that we are facing.

Given the outlook and possible further rate rises, we have decided to reduce exposure to Infrastructure by selling Clearbridge Infrastructure Income fund and reallocate the funds to Realm High Income fund.

Infrastructure assets have been negatively affected by interest rate rises, whereas Realm High Income fund, being an actively managed diversified Credit fund, has had the ability to use rate rises to their advantage ( 12 month return +9.34%). We have maintained a small exposure to Infrastructure by retaining IFRA, as we see the potential for a rebound in prices when rates begin to fall, which may be in 2024/25.

The model portfolios are now sitting neutral (50% in the 40% to 60% model portfolio #3) and we have adequate cash to employ when we deem appropriate.

We encourage investors to invest in accordance with your tolerance to risk and remember that diverse asset allocation is key to investment portfolio success. The graph below demonstrates the varying likely ranges of returns, for varied growth allocations. As the graph shows, even highly defensive portfolios can have periods of double-digit negative returns, but it is important to stick the course and not get too concerned about short term fluctuations , as history has shown that time in the market results in a higher probability of positive returns.

Economic update

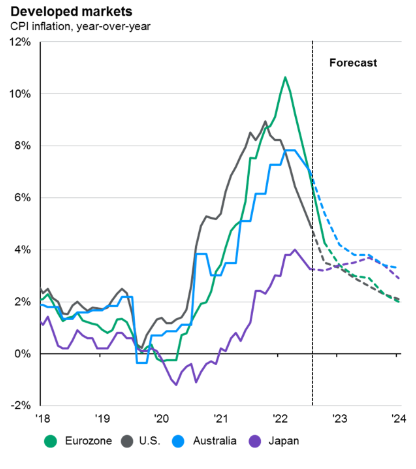

Global inflation is trending down, however Australian rents and services remain high and sticky.

In recent weeks oil fell from $94 to $84, after surging 30% in 3 months. The conflict in Israel has seen a spike in oil back to $87.

We will continue to monitor this price movement, as it will have an impact on equities as well as inflation.

Source: JPM Guide to markets 2023

The model portfolio’s remains heavily tilted to developed markets – US and Australian stocks, with a preference for high quality. As seen below, quality stocks tend to perform during periods of recessions and periods of volatility.

Despite the challenging conditions with a high US dollar, we have held our positions in Europe, China and Emerging Markets, as we believe they are currently undervalued and have good long-term potential to contribute growth into the portfolio.

Source: JPM Guide to markets 2023

If you wish to review your risk profile, or if you do not invest in the model portfolio and wish to discuss your investment allocations, please contact your Advisor.