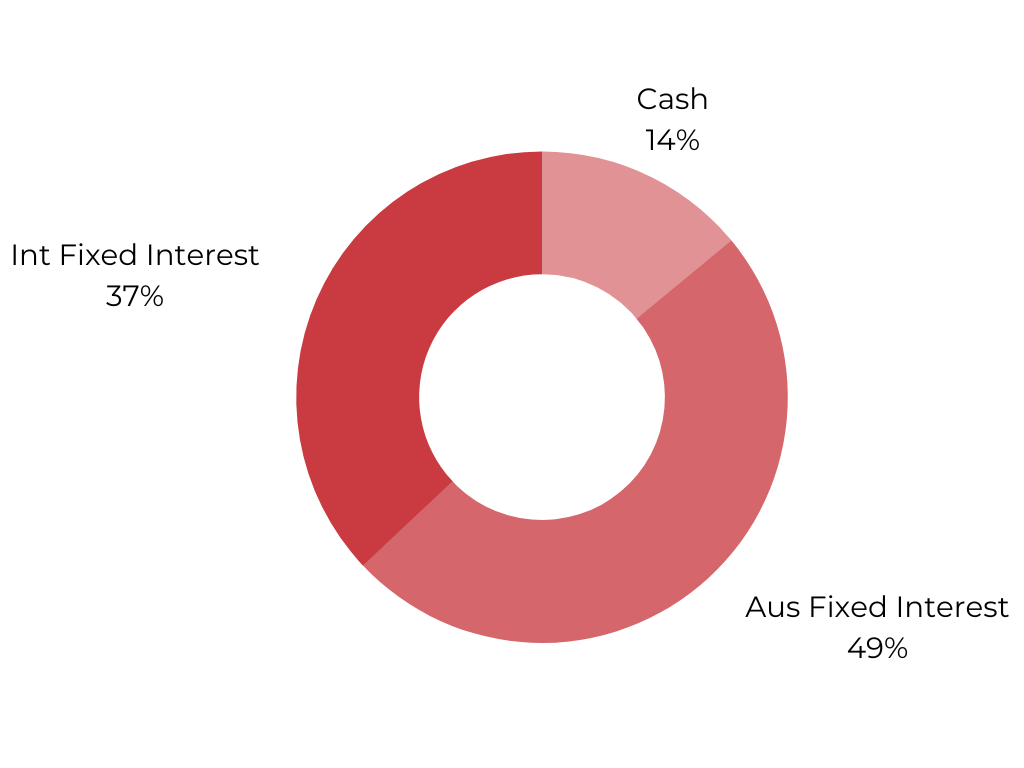

High Income

Aims to deliver a total income return of over 3% p.a (net of all fees). The fund is actively managed and provides diversification across Australian and global fixed interest markets thereby minimising the risk of any capital loss.

Investors seeking an alternative source of income without taking on excessive risk.

100% defensive (fixed interest, cash)

3% plus (net of all fees) through the market cycle

Low

1-2 years+

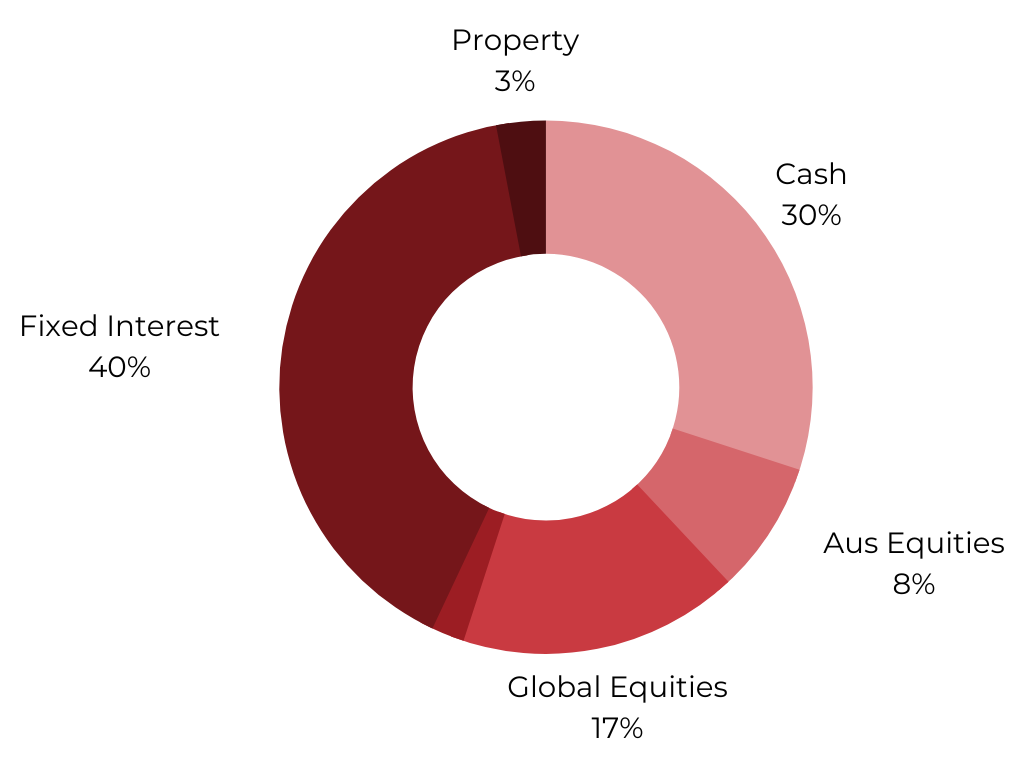

Moderately Defensive

Aims to provide investors with modest capital appreciation and income over periods of three years or more by investing in a diversified portfolio of predominantly defensive assets

Investors wanting stable income and a high degree of capital stability

70% defensive (fixed interest, cash)

30% growth (equities, property, alternatives)

CPI plus 2% in any rolling 3 year period

Low to medium. Negative return 3 years in every 20 years

3 years+

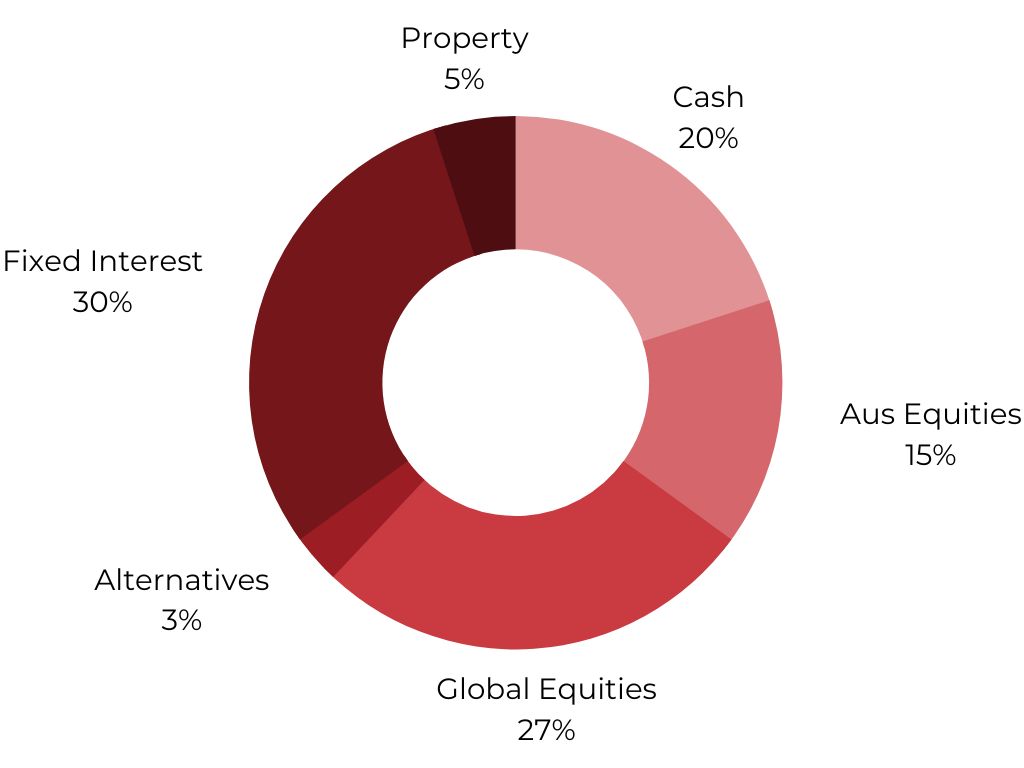

Balanced

Aims to provide investors with a moderate income and capital growth over periods of 5 years or more by investing in a diversified portfolio split equally between growth assets and defensive assets

Investors seeking a careful balance between risk and reward

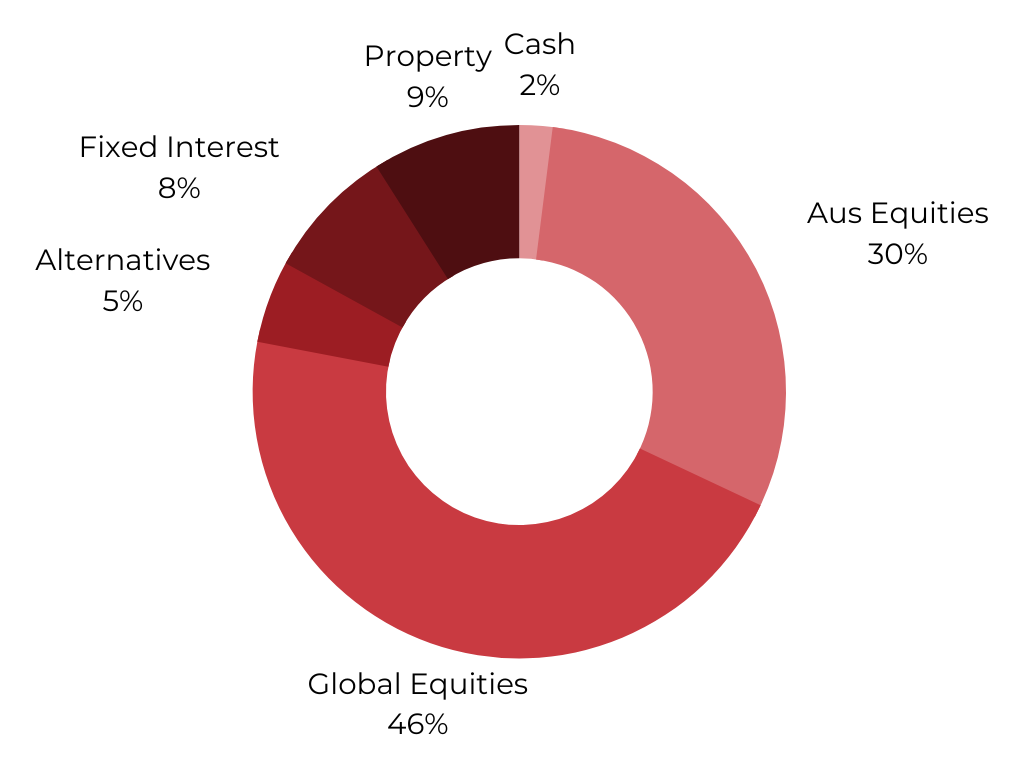

50% defensive (fixed interest, cash)

50% growth (equities, property, alternatives)

CPI plus 3% in any rolling 5 year period

Medium. Negative return 4 years in every 20 years

5 years+

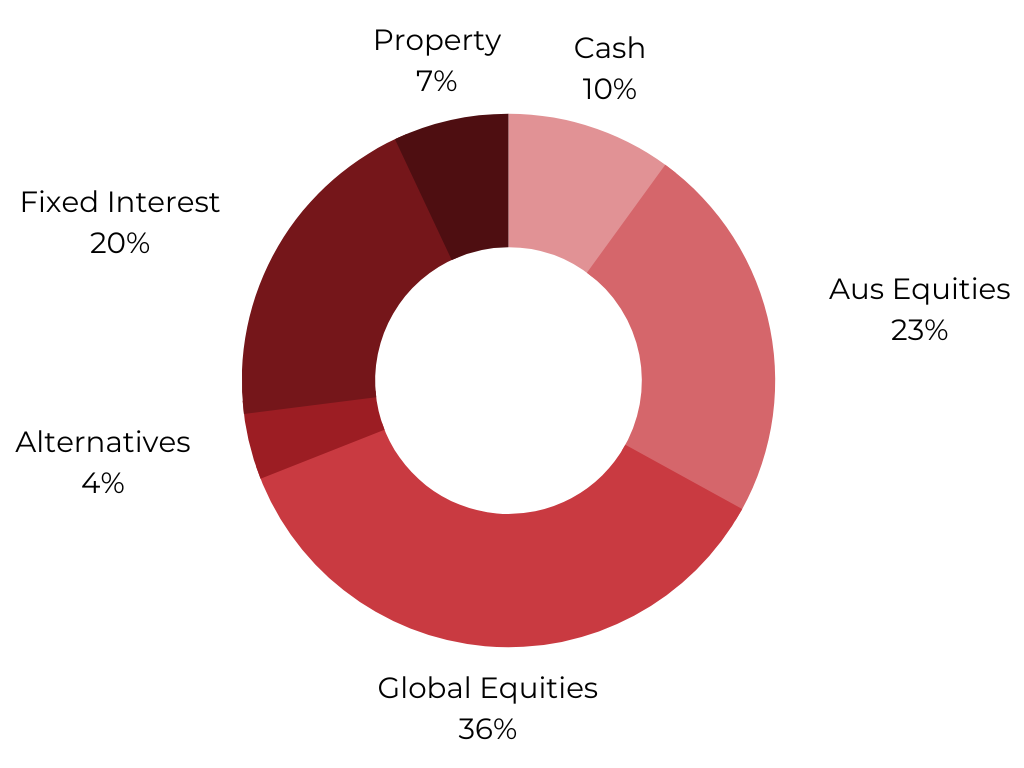

Growth

Aims to provide investors with a higher rate of return over periods of 7 years or more by investing in a diversified portfolio of predominantly growth assets

Investors looking for higher potential investment performance and who are prepared to accept increased risk and volatility in order to achieve it

30% defensive (fixed interest, cash)

70% growth (equities, property, alternatives)

CPI plus 4% in any rolling 7 year period

High. Negative return 5 years in every 20 years

7 years+

High Growth

Aims to maximise total returns over a period of 8 years or more by investing in a diversified portfolio of majority growth assets

Investors seeking to maximise their total returns over the longer term and are prepared to tolerate a high degree of market volatility along the way

10% defensive (fixed interest, cash)

90% growth (equities, property, alternatives)

CPI plus 5% in any rolling 8 year period

Very high. Negative return 5 years in every 20 years

8 years+

View actual returns and fees

Socially Responsible Balanced

Aims to provide investors with a diversified portfolio split equally between growth assets and defensive assets, taking into account the social and environmental impact of the chosen companies

Suited to investors seeking a careful balance between risk and reward and who wish to make a positive social impact

50% defensive (fixed interest, cash)

50% growth (equities)

CPI plus 3% in any rolling 5 year period

Medium. Negative return 4 years in every 20 years

5 years+